The global duty-free liquor market size reached a value of around USD 17.59 billion in 2023. The market is further expected to grow at a CAGR of 11.2% between 2024 and 2032, reaching a value of around USD 45.88 billion by 2032. This significant growth reflects the increasing demand for duty-free liquor driven by expanding international travel and the allure of tax-free prices.

Market Share and Size

Duty-free liquor remains a lucrative segment within the travel retail industry, contributing substantially to overall sales. With the current market size at USD 17.59 billion, this sector is poised for robust growth, driven by rising disposable incomes, changing consumer preferences, and the expansion of travel retail networks worldwide. The projected market size of USD 45.88 billion by 2032 underscores the potential of this market.

By Type

Beer

Beer accounts for a substantial share of the duty-free liquor market. As one of the most consumed alcoholic beverages globally, beer's market share is bolstered by its popularity among travelers. Key regions contributing to beer sales include North America and Europe, where craft and premium beers are in high demand.

Wine

Wine is another significant segment in the duty-free liquor market. The diversity of wine varieties, from red and white to sparkling and rosé, attracts a broad consumer base. European wines, particularly from France, Italy, and Spain, are highly sought after in duty-free stores, contributing to the segment's growth.

Vodka

Vodka holds a notable market share, driven by its versatility and widespread appeal. Key consumer demographics include younger travelers and those from Eastern Europe and North America. Premium and flavored vodkas are particularly popular in duty-free outlets, enhancing their market presence.

Whiskey

Whiskey remains a dominant force in the duty-free liquor market, with strong demand from travelers in North America, Europe, and Asia Pacific. The segment is characterized by a preference for aged and premium whiskies, which are often exclusive to duty-free stores, making them a prized purchase for many travelers.

By Channel

Cruise Liners

Cruise liners play a significant role in the duty-free liquor market. With a captive audience and a leisurely shopping environment, these floating retail hubs see strong liquor sales. Key trends include the preference for premium and exotic liquor brands among cruise passengers.

Airport

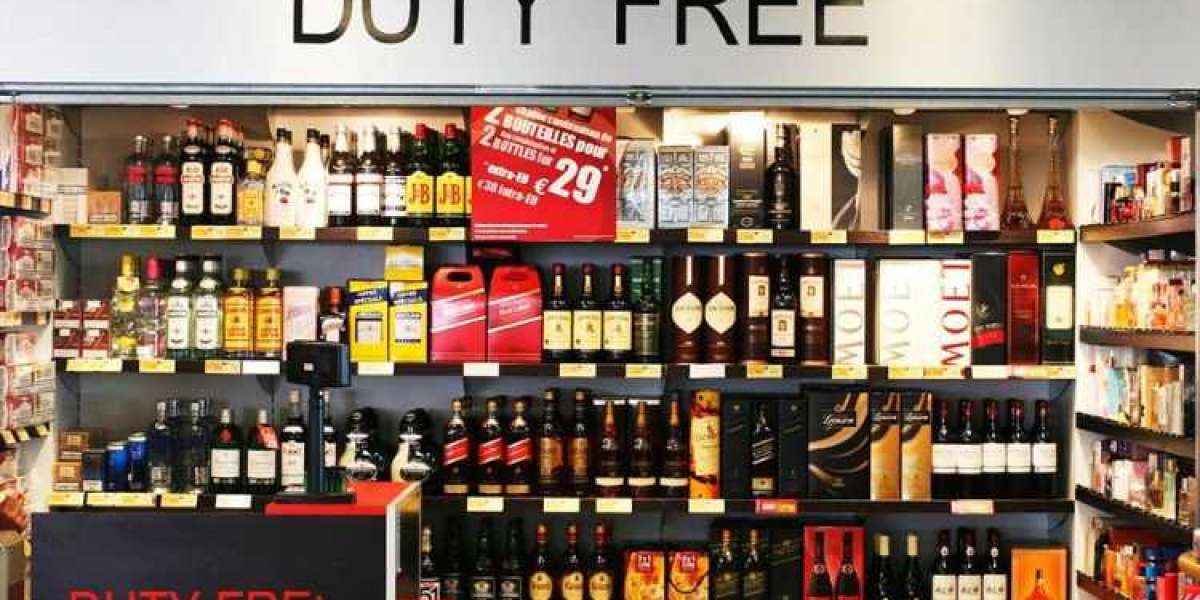

Airports dominate duty-free liquor sales, benefiting from high passenger traffic and strategic store placements. Major airports in regions like the Middle East, Europe, and Asia Pacific are leading contributors to this channel, offering an extensive range of liquor brands to cater to diverse traveler preferences.

Railway Station

Although an emerging channel, railway stations show promising growth potential in duty-free liquor sales. Key regions include Europe and Asia, where high-speed rail networks and increasing passenger volumes drive sales. This channel offers convenience and accessibility for travelers looking to make quick purchases.

Others

Other channels, including downtown duty-free shops and border stores, also contribute to the market. These outlets provide additional touchpoints for travelers to purchase duty-free liquor, often offering unique promotions and exclusive products.

Regional Analysis

The duty-free liquor market exhibits varied growth across different regions:

- North America: High demand for premium spirits and wines, with significant contributions from major airports and cruise liners.

- Europe: A mature market with strong sales in whiskey and wine, driven by major hubs like Heathrow and Charles de Gaulle.

- Asia Pacific: Rapid growth fueled by increasing travel and rising disposable incomes, with a preference for premium and luxury liquors.

- Latin America: Emerging market with growing demand for beer and spirits, supported by expanding travel retail networks.

- Middle East Africa: High per capita spending on duty-free liquor, particularly in the UAE and Qatar, driven by luxury travel.

Market Dynamics

SWOT Analysis

- Strengths: Strong brand presence, exclusive product offerings, and tax-free prices.

- Weaknesses: Regulatory challenges and dependency on international travel.

- Opportunities: Expansion in emerging markets, growth in e-commerce, and increasing premiumization.

- Threats: Economic downturns, geopolitical tensions, and competitive pressures.

Porter’s Five Forces Analysis

- Competitive Rivalry: High, with numerous global and regional players.

- Threat of New Entrants: Moderate, due to high capital requirements and regulatory barriers.

- Threat of Substitutes: Low, as duty-free liquor offers unique advantages.

- Bargaining Power of Suppliers: Moderate, influenced by brand strength and exclusivity deals.

- Bargaining Power of Buyers: High, driven by price sensitivity and brand loyalty.

Competitive Landscape

The duty-free liquor market is characterized by the presence of major players such as Diageo, Pernod Ricard, LVMH, and Bacardi. These companies dominate the market through extensive product portfolios, strategic partnerships, and strong branding efforts. Recent developments include product launches, expansion into new markets, and innovative marketing strategies.

Key Trends and Developments

Key trends shaping the market include the rise of digitalization in travel retail, with online pre-ordering and home delivery services gaining traction. There is also a notable shift towards premium and craft products, driven by consumer demand for unique and high-quality offerings. Additionally, sustainability and ethical sourcing are becoming increasingly important to consumers, influencing their purchasing decisions.

Market Forecast (2024-2032)

The duty-free liquor market is set for substantial growth, with a projected CAGR of 11.2% from 2024 to 2032. Factors such as increasing global travel, rising disposable incomes, and the expansion of travel retail infrastructure will drive this growth. Stakeholders should focus on leveraging digital platforms, enhancing product assortments, and tapping into emerging markets to capitalize on these opportunities.